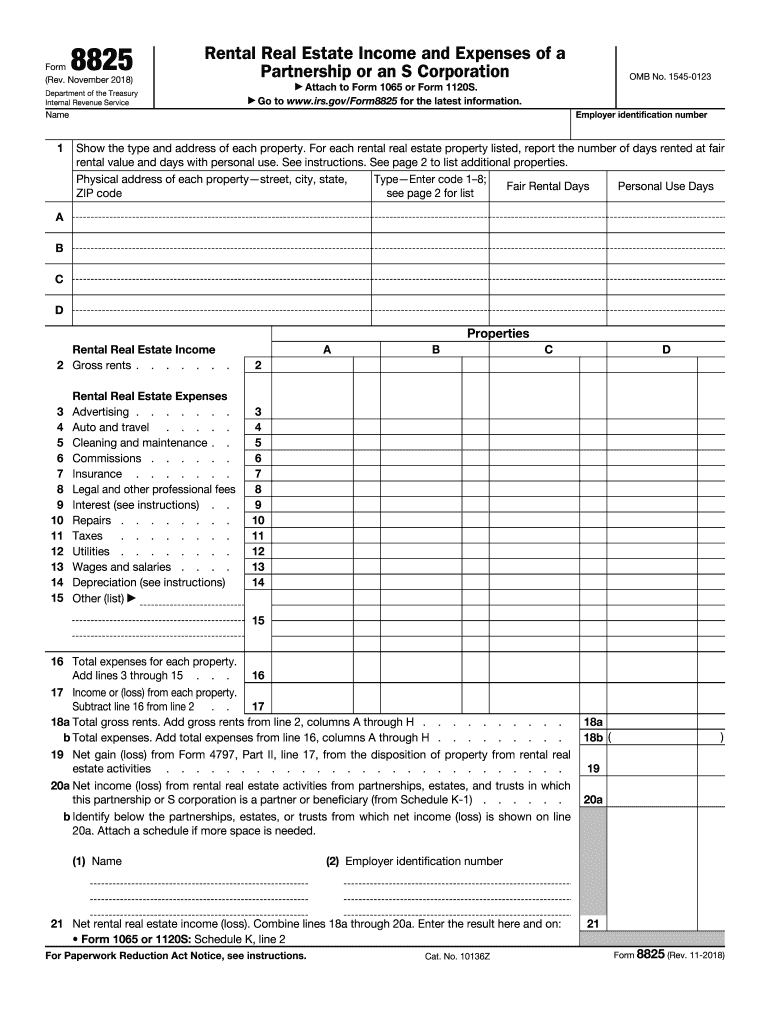

Who needs Form 8825?

This form is completed by partnerships and S corporations to report income, expenses, and deductible expenses from various real estate activities. For example, if a partnership or S corporation owns an apartment building and rents out apartments in it to individuals or other business entities, it should complete this form.

What is the purpose of Form 8825?

This IRS form is used to report the rental income of the partnerships and S corporations. The information is essential for a tax return and IRS officials will use it to calculate the amount of tax the partnership or S corporation should pay for a specific fiscal year.

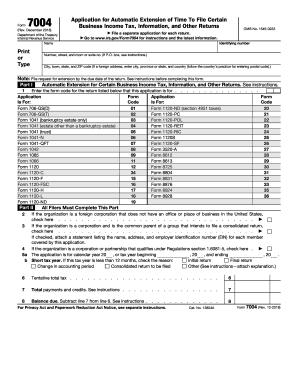

What documents must accompany Form 8825?

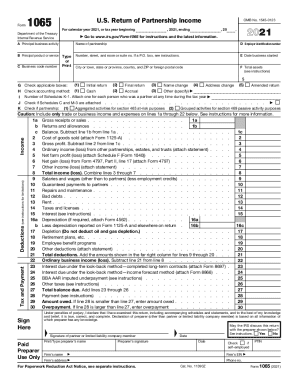

This schedule is attached to Form 1065, Form 1065-B (Return of Partnership income) or Form 1120S (Corporation Income Tax return) depending on the type of the business.

When is Form 8825 due?

This form should be filed with the IRS when it is time to submit the related tax forms, 1065 or 1120S. The estimated time for completing this form is two hours. More time is required to collect all the necessary information and to file the form with the IRS.

What information should be provided in the Form 8825?

The taxpayer should add the following information:

- Name of the taxpayer

- Employer identification number

- Address of the property

- Rental real estate income (gross rents)

- Rental real estate expenses (advertising; auto and travel; insurance; taxes; wages and salaries; legal and other professional fees; cleaning and maintenance; commissions)

- Type of real estate property (single family residence; multi-family residence; commercial; land, etc.)

What do I do with the form after its completion?

The completed form should be filed with the local IRS office together with other required forms and schedules.