IRS 8825 2018-2025 free printable template

Instructions and Help about IRS 8825

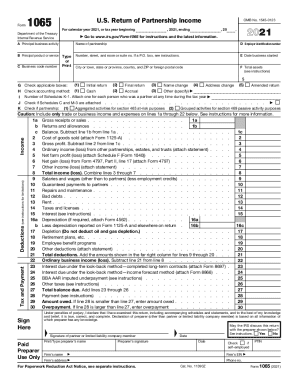

How to edit IRS 8825

How to fill out IRS 8825

Latest updates to IRS 8825

All You Need to Know About IRS 8825

What is IRS 8825?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

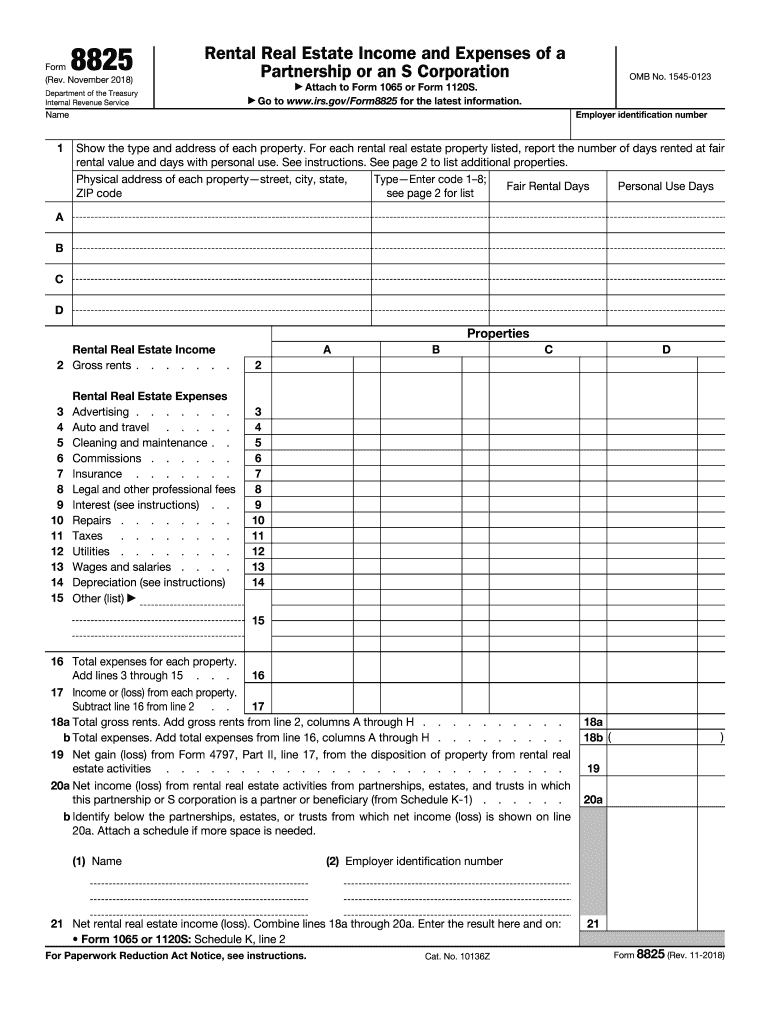

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

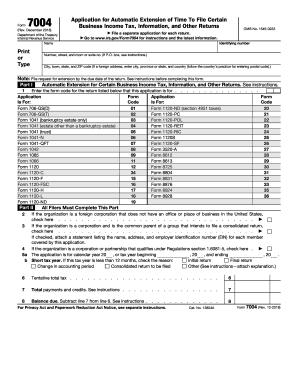

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8825

What should I do if I need to correct errors on my IRS 8825 form?

If you discover errors after filing your IRS 8825, you should prepare to submit an amended form. Gather the necessary documentation to reflect the corrected information accurately. Ensure you clearly indicate that it is an amended return to avoid confusion in processing.

How can I verify the status of my submitted IRS 8825?

You can verify the status of your submitted IRS 8825 by accessing the IRS e-file status page. Make sure to have your submission details handy, as you may need them to retrieve the status. Be aware of common e-file rejection codes to troubleshoot if there are issues.

What are some common errors filers make with the IRS 8825, and how can they be avoided?

Common errors on the IRS 8825 include misreporting income and expenses or failing to maintain appropriate documentation. To avoid these pitfalls, review your calculations meticulously and ensure all supporting documents are complete and organized before submission.

Are there specific requirements for e-signatures on the IRS 8825?

E-signatures are acceptable for the IRS 8825 as long as they meet IRS specifications. It's essential to use approved software solutions that comply with IRS rules to ensure your submission is valid. Always check the latest IRS guidelines for any updates on e-signature policies.

See what our users say